Sitting down with a professional and following this simple budget plan could be the most important thing you do all year.

Sitting down with a professional and following this simple budget plan could be the most important thing you do all year.

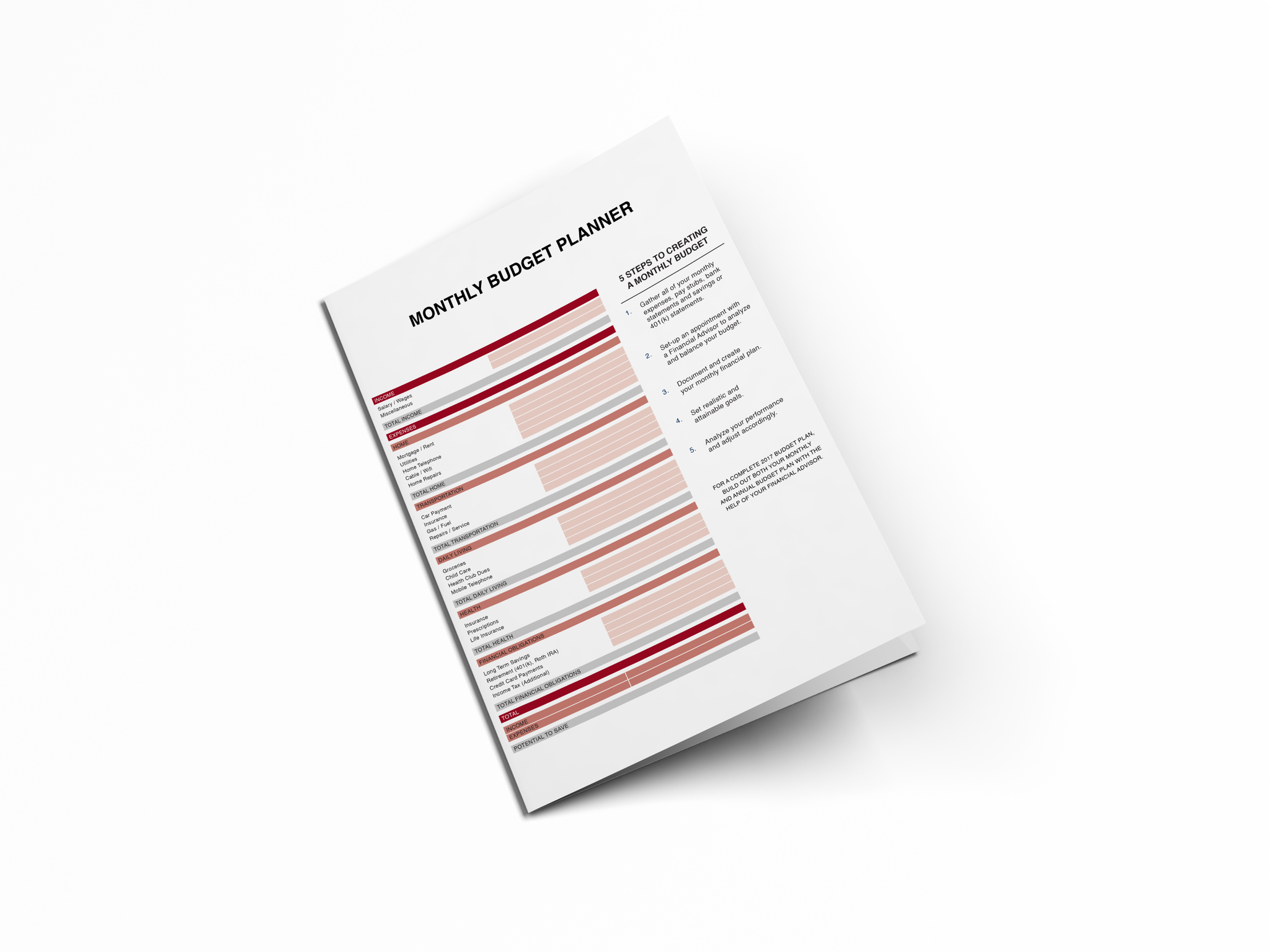

Follow these 5 Steps when creating a monthly budget:

- Gather all of your monthly expenses, pay stubs, bank statements and savings or 401(k) statements.

- Set-up an appointment with a professional to analyze and balance your budget.

- Document and create your monthly financial plan.

- Set realistic and attainable goals.

- Analyze your performance and adjust accordingly.

Use this worksheet to help determine what your monthly (and then annual) expenses are – then use these numbers as reference with our Retirement Income Gap Calculator worksheet to help determine if you have enough guaranteed income to meet your ESSENTIAL expenses in retirement.