It’s been asked a million times: “What are the three most important financial goals you’d like to achieve with your investment portfolio?”

Typically, people share the same sentiments:

- Supplement retirement funds

- put kids through college

- maybe buy some property, like a vacation home

But is that REALLY what you are looking to get out of your retirement?

What is it that makes a retirement plan a “good” retirement plan?

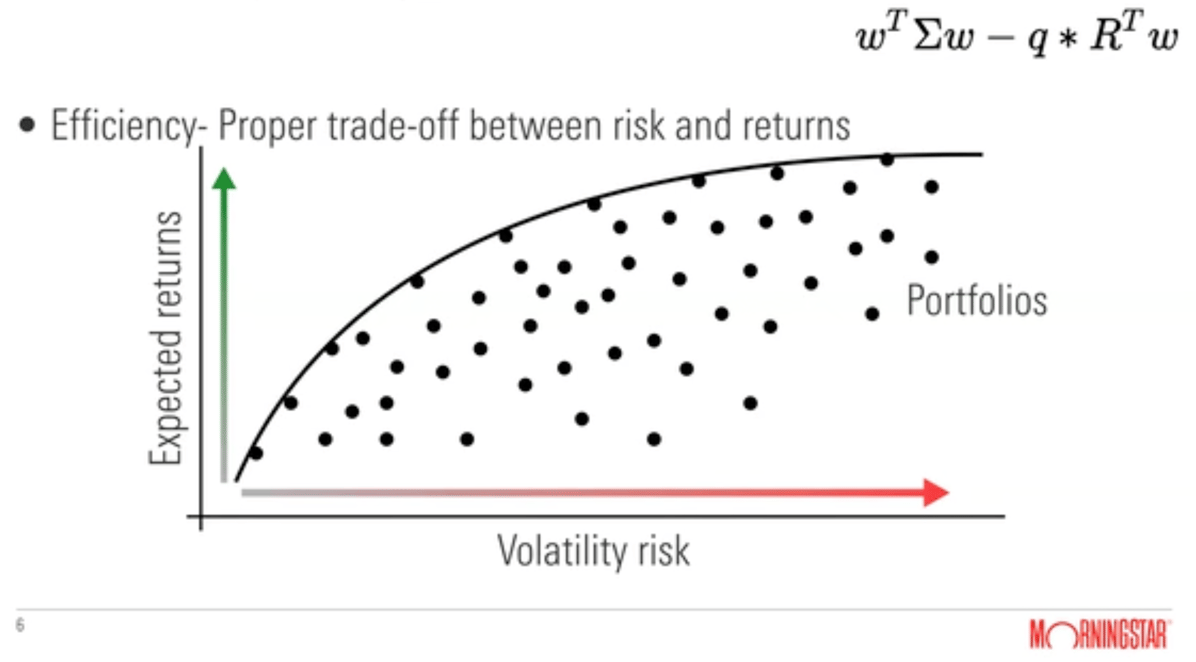

Some would argue that it’s simply a mathematical equation, where you are constantly working to determine the proper efficiency of your portfolio: calculating the proper trade-off between risk and returns based on a number of other factors (like your personal tolerance & your portfolio’s risk capacity).

The equation is often referred to as the Efficient Frontier (introduced by Nobel Laureate Harry Markowitz in 1952), and this calculation assumes that as long as you follow certain criteria for investments based on those risk factors, you’ll be able to create a retirement plan that is quite successful (on paper.)

|

While efficiency modeling IS necessary to build a “good retirement plan” (unless you are INTO the idea of investing in crazy risky things with minimal expected returns 🥴), it isn’t really a sufficient way of running a portfolio through 20+ years of retirement.

There are other (arguably bigger) parts of retirement planning that too many advisors/financial professionals/wealth managers don’t discuss when working with people who are nearing retirement. One of them being:

EFFECTIVENESS.

But, what is the determining factor for measuring the effectiveness of a retirement plan?

One that helps you reach your goals.

“If You Don’t Know Where You Are Going, You’ll End Up Someplace Else.”

Wise words from Yogi Berra.

Building a retirement plan that helps you reach your goals in retirement is a no-brainer.

Why WOULDN”T you want your hard earned assets working for you to help you achieve the lifestyle you’ve been yearning for…

But “what are your goals” is a simple question that can actually be quite tricky to answer.

We noted in a previous article that people tend to want a simple answer when it comes to their retirement portfolio.

Which is understandable.

You’ve worked HARD, for a LONG time (most of your life, I’d bet 😉 ), and you want to know if all your hard work has paid off.

If you know you have saved enough money to have the option to stop working, that IS QUITE an achievement.

At the start of working with a retirement professional, you (along with most others in your situation) might default to thinking your “goal” is to maximize your returns while minimizing risk in your portfolio.

However, if the answers to our retirement questions aren’t as cut and dry as we hope them to be, WHY do we strive for a specific number to feel like we’ve ensured a stable retirement?

Maria Konnikova wrote in a 2013 New Yorker article (Why We Need Answers):

“When we can’t immediately gratify our desire to know, we become highly motivated to reach a concrete explanation. That motivation, in {psychologist Jerome} Kagan’s conception, lies at the heart of most other common motives: achievement, affiliation, power, and the like. We want to eliminate the distress of the unknown.”

When we lack a clear connection between our present reality and the future we’d like to achieve, it’s easy to get off track and lose our momentum.

So, how can we stay on track to achieve our retirement goals?

Start by asking yourself WHY you have set a specific financial goal.

“Why do I want to (obtain this financial goal)?”

Financial goals to earn more, save more, or build wealth are usually linked to a deeper desire, like the desire to have more time, more freedom, or an earlier retirement date.

So, dig deeper and ask yourself why again:

“WHY do I desire this?”

With this “why,” you’re getting more personal – digging into how your motive for a financial goal is directly connected to your drive in life.

Maybe you want to live in a more comfortable lifestyle, travel more, spend more time with your loved ones, or provide for your family.

Most people might stop here, and think those details are enough to justify their “goals” in retirement, but to TRULY build a goal-oriented portfolio, we need to ask “why” a third time:

“Why do I want to (fulfill this personal desire)?”

Deep inside your goals are the vivid reasons that drive you. Get specific and figure out EXACTLY how this dream fits into your life, your relationships, and your values.

The answer to this third “why” should be deeply emotional and connected to who you are and what you value.

Not sure if what you came up with rings true to you?

You’re not alone – A Morningstar report discovered that when clients were asked to spend three to five minutes identifying their three most important financial goals, 76% of people changed at least one of their main goals when presented with a checklist of common financial goals after the initial exercise.

So, let’s take a moment to do that now. Think about the goals you just created with the exercise above, and click here to look at and consider the questions included in our “Master List Of Goals” Checklist.

The goal isn’t to confront ignorance— the aim is to enable you to better articulate what motivates you.

Now, once you better understand WHY you are investing, your plan can be oriented toward reaching those goals.

A good retirement plan?

Well, it’s really just a means to an end, right?

“If you aim at nothing, you will hit it every time.” – Zig Ziglar

As great as setting goals is, it won’t accomplish much for you if you can’t set a process to achieve them. And, maybe not so surprisingly, the vast majority of people (92% according to the research) don’t achieve their goals.

A Northwestern Mutual study underscores the powerful impact of working with a financial advisor on your overall confidence. The research found those who work with an advisor are 31% more confident about being prepared for unplanned expenses.

Goals provide a good benchmark to help you understand if you are on the right track.

Goals provide a more useful “compared to what” that market indexes do.

Focusing on goals can counter the decision biases people fall prey to when they think they need to be chasing returns as compared to other markets or portfolios.

A goals-based portfolio can help an investor stick with their strategies and portfolio over the long-term.

So again, what makes for a “good retirement plan?”

One that helps you reach your (hopefully now well defined) goals.

It’s not just efficiency, but also effectiveness (reaching your goals) and ENDURABILITY (the ability to stick with a strategy for the long-term) that will help set you up for financial success.

Helping you meet your goals fuels our work here at Rubino & Liang Wealth Partners. But just like everything else, goals can change.

Even changes that seem modest can affect your financial plan.

That’s why our 365 Retirement Planning process is built to include client reviews, it’s designed to be a tool that allows you to frame your priorities as they relate to:

- Retirement and lifestyle goals.

- Tax planning and healthcare goals.

- Self-development and professional goals.

- Estate planning and wealth transfer goals.

Take a moment again and consider the questions included in our checklist The Master List Of Goals.

Whether you answer “YES” to one question or several questions, let’s talk.