Many of the motivations to sell an asset are rooted in some kind of behavioral bias.

Many of the motivations to sell an asset are rooted in some kind of behavioral bias.

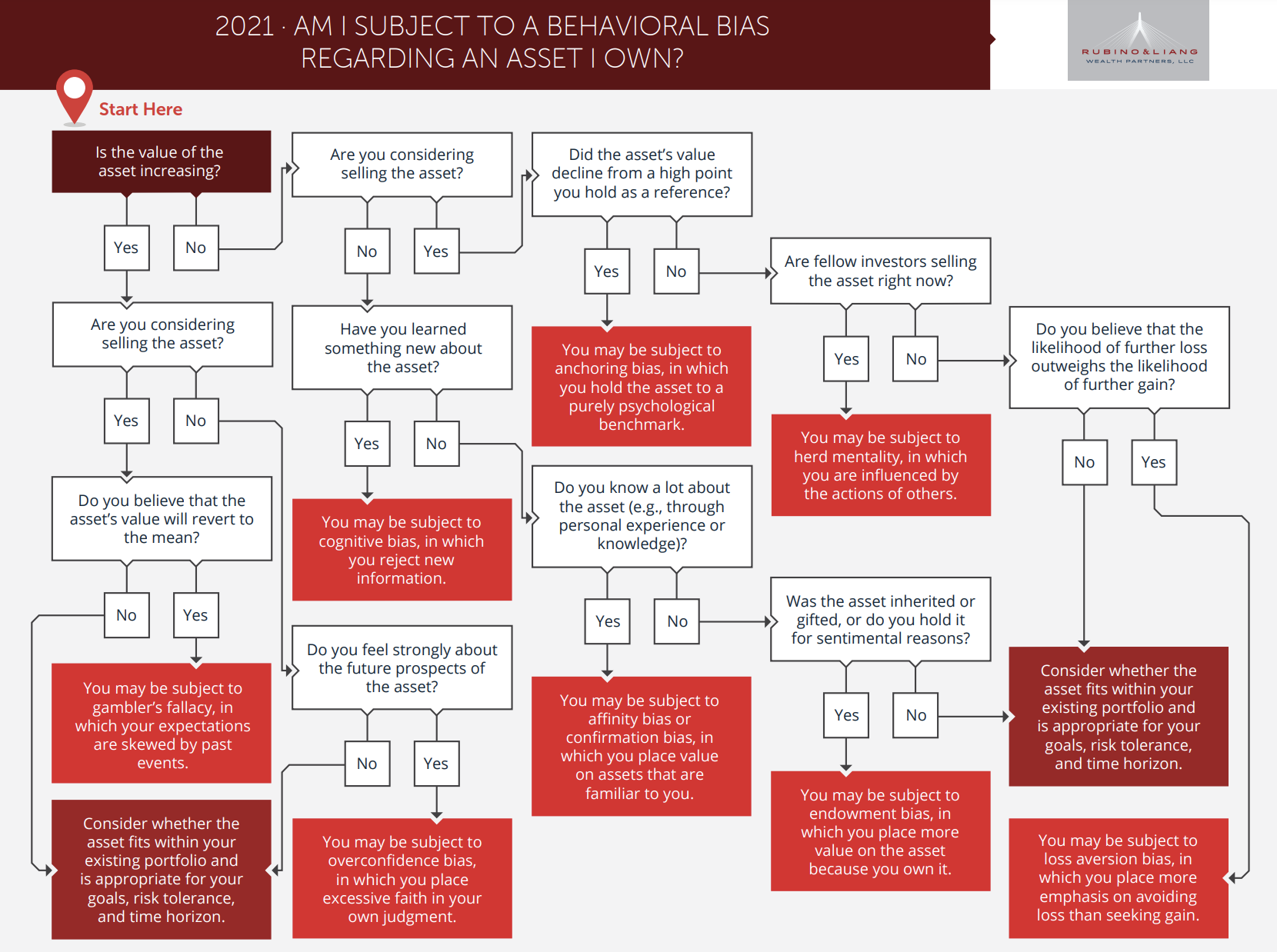

At times, it can be difficult to understand why certain assets should (or should not) remain in your portfolio, without first understanding the tendencies that may be affecting your judgment.

Use this flowchart to help guide your conversations regarding some of the most common behavioral biases. It covers:

- Overconfidence

- Gambler’s fallacy

- Cognitive bias

- Endowment bias

- Anchoring bias

- Affinity/confirmation bias

- Herd mentality

- Loss aversion bias