4 Uncomfortable Retirement Truths No One Talks About

In this video we discuss four uncomfortable retirement truths no one talks about. Across our many years operating in the financial space, we’ve seen firsthand how ignoring this critical retirement advice can derail even the best-laid retirement plans. That’s why we’ve decided to make this video – to share four uncomfortable retirement truths that […]

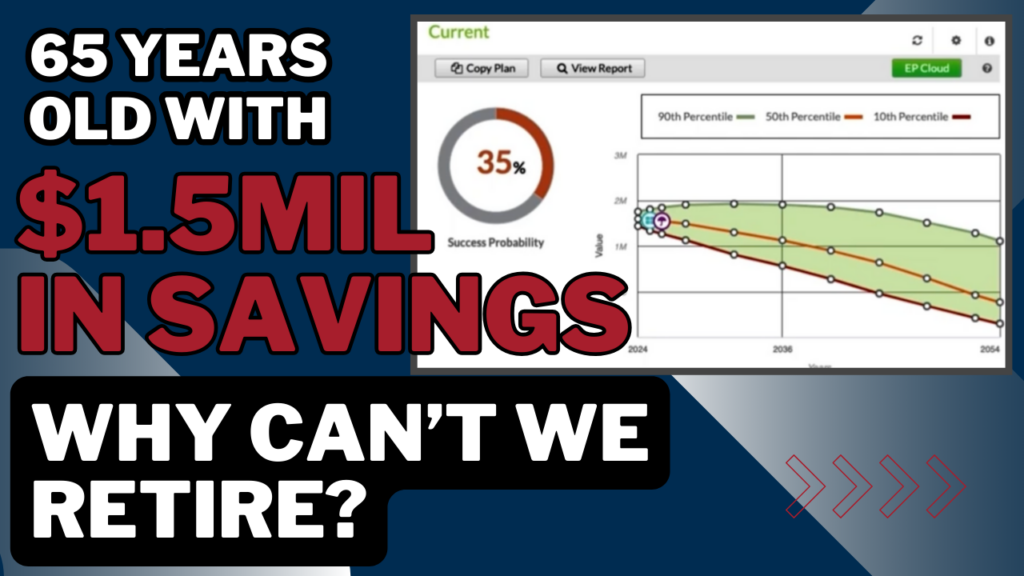

65 With $1.5 Million in Savings, Why Can’t We Retire?

If you’re around the age of 65 with around $1.5 million saved up for retirement, but still can’t retire, you may be wondering why. Today we’ll be analyzing how someone who is 65 and has $1.5M saved still can’t retire… The decision-making process John Conley shares with you in this video is the exact […]

The Simple 3-Step Medicare Guide

When, Why, and How to Choose a Plan That’s Right For You (Especially if you’re already enrolled) Whether you’re looking into Medicare for the first time, or taking advantage of Annual Enrollment to update your strategy, we’ve broken down the critical choices you must make into a simple decision-making tool (including the easy-to-understand questions you […]

The Dangers of Investing FOMO

When you see headlines like, “Nvidia becomes world’s most valuable company…”5 Or read that a few stocks are responsible for most of the market’s gains… Or see some newsletter bragging about a X,XXX% return on a single stock pick… It’s natural to wish you could go back in time, invest in a […]

Why Are Retirees So Afraid To Spend In Retirement?

The fear of running out of money is so real that many retirees don’t spend and perhaps aren’t enjoying their retirement like they could. When asked “How often do you withdraw funds from your retirement accounts”: 52% Only as needed. 30% Never 16% Systematically and regularly Crazy, right? What’s more interesting is that JP Morgan-Chase did a […]

The Three E’s Of A “Good” Retirement Plan?

It’s been asked a million times: “What are the three most important financial goals you’d like to achieve with your investment portfolio?” Typically, people share the same sentiments: Supplement retirement funds put kids through college maybe buy some property, like a vacation home But is that REALLY what you are looking to get out […]

Risk Tolerance Vs. Risk Capacity: How Psychology Can Ruin Your Retirement Plan

In the realm of investing and retirement planning, two crucial ideas are frequently interchanged, but possess separate definitions – risk tolerance and risk capacity.