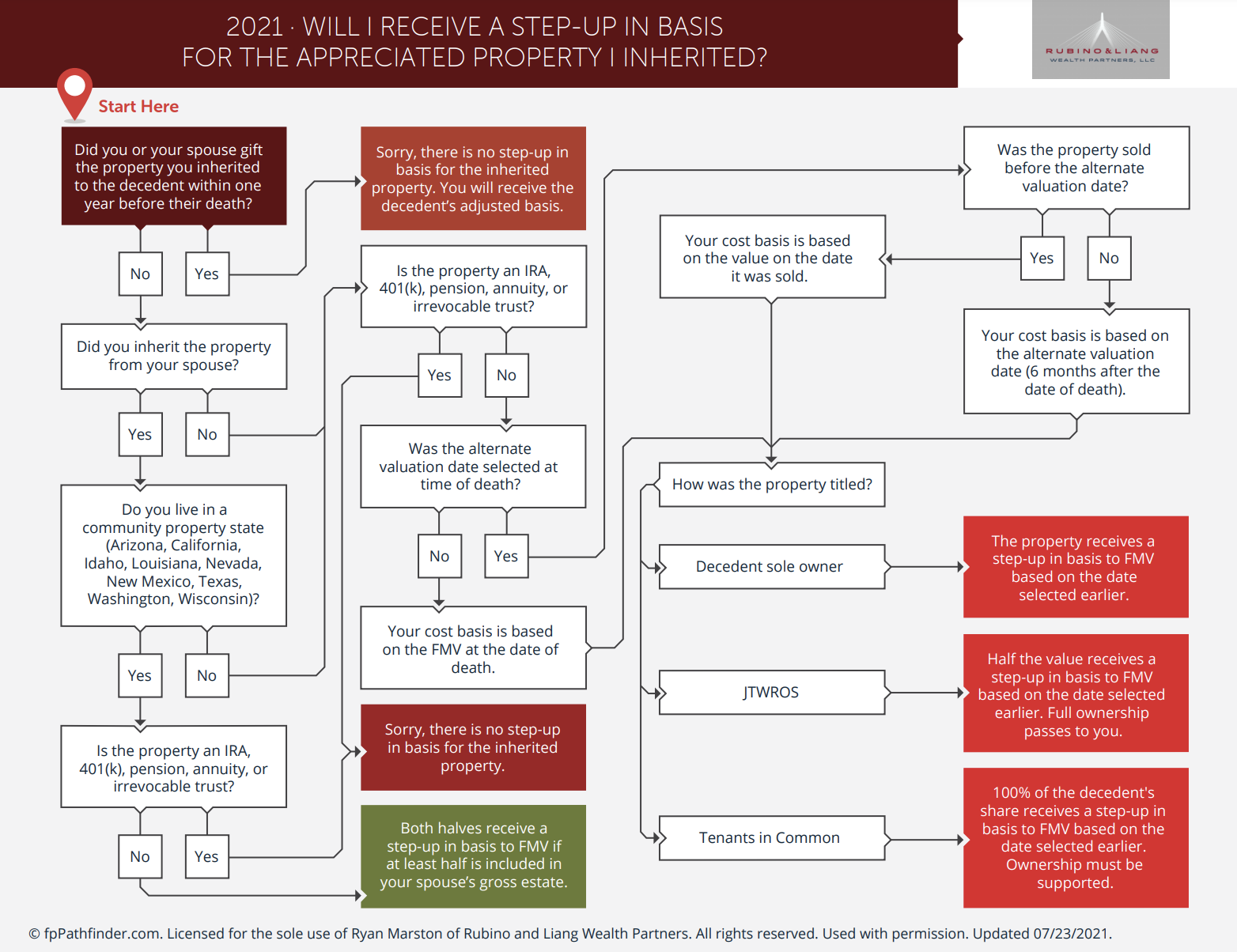

In most cases, there is a step-up in basis when property is transferred from a decedent.

In most cases, there is a step-up in basis when property is transferred from a decedent.

But, there ARE a few exceptions and some subtle distinctions to keep in mind when you inherit property (be it land/house, retirement accounts, annuity, trust, etc.).

To help make this analysis easier, use this “Will I Receive A Step-Up In Basis For The Appreciated Property I Inherited?” flowchart.It addresses some of the most common issues that arise for those trying to understand their cost basis in property they inherit. This flowchart considers:

- Impact of living in a community property state

- Types of property that receive a step-up

- Impact of selecting the alternate valuation date

- Simple ownership vs JTWROS vs tenants in common